Technical Analysis

- probabilistic forecasts of future price behaviour based on price history

- risk management tool

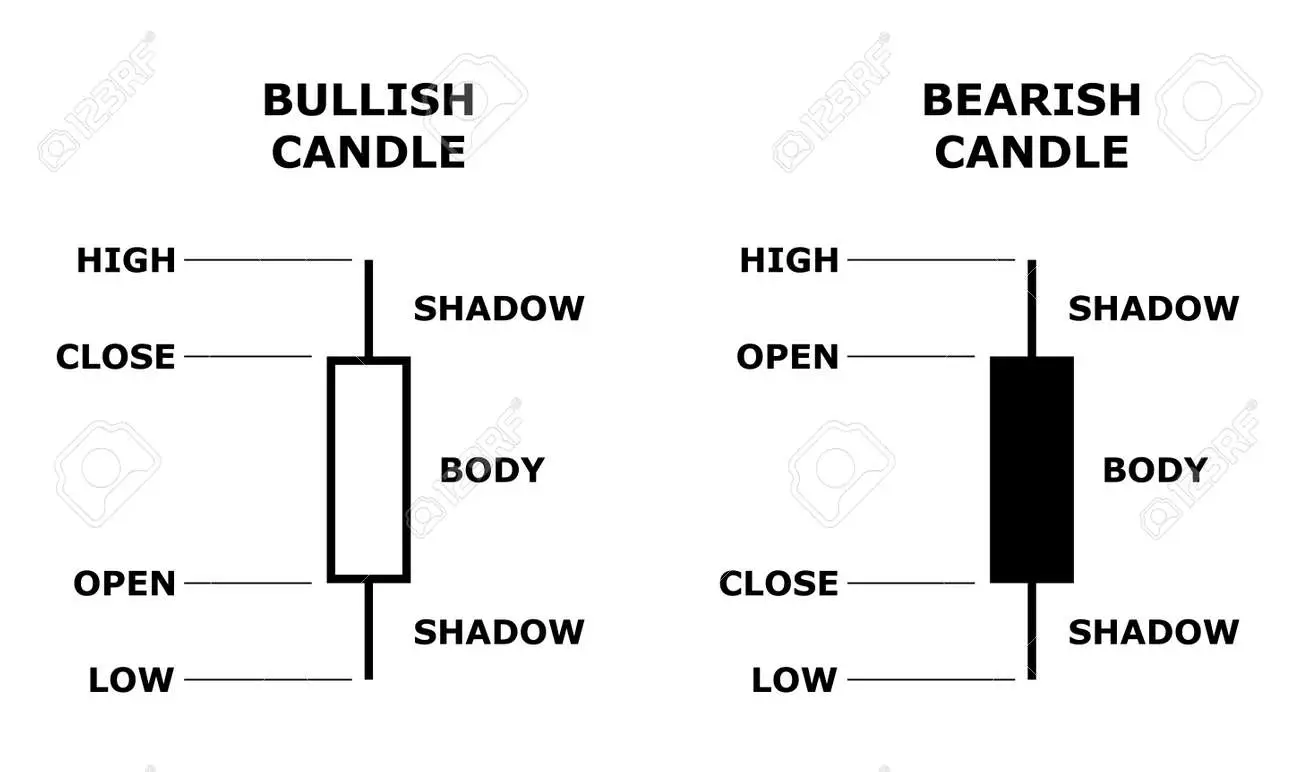

Candlestick Charts

OHLC

- Open

- High

- Low

- Close

useful for mapping out weekly open, daily open, high/low of the day, precise high/low of a given move, whether price closed through a level or swing point

Timeframes

time period that one candle represents

beginners should focus on higher time frames (daily D1, hourly H1) to not get caught up in the noise

Candlestick Patterns

impt:

- swing high/swing low

- doji

- shooting star/hammer

- engulfing

- tweezers

don't disregard timeframes and trade any patterns - look for htf, clear patterns where it makes sense to do so. context is impt - pay attention to reversal pattern where there is a strong trend

- USE HIGHER TIME FRAMES

- ZOOM OUT

Risk Management

General Remarks

- survival is the priority

- never risk your ability to take risk

Invalidation

evidence that suggests the probability of an idea coming to fruition is reduced such that the risk is no longer justified

Invalidation always closely tied to the idea itself

types of invalidation:

- priced-based

- time-based

- volatility-based

Stop Losses I

a stop loss is a order (often a market order) to fully close a position at a certain price or loss threshold

- market order: guaranteed execution, fill price may be unfavourable

- limit order: if it 'skips' your price and the market teleports, you're fucked

- not all trades have an obv stop loss

stop loss placement

- where setup obv calls for it (clear invalidation)

- idea is obv wrong if price trades to the stop order

Stop Losses II

- stop placement inextricably linked with the trade idea itself (shit idea = shit stop placement)

- if you don't know where to put a stop, that often means the idea itself is not defined very clearly or that the setup isn't particularly good

- simple eye test: would i want to buy where my long gets stopped out / would i want to sell where my short gets stopped out? if yes, consider revising

Stop Losses III

- strictness with stop usage and placement inversely correlated with the size of the move you're trying to trade

- hard stop

- for clearly defined setups

- market order to fully close

- soft stops

- 'mental' stop, mix of market and limit orders if invalidation criteria begins to be satisfied

- for swing trades

- use hard stops for beginners

- read trading riot risk management blog post